Impressive Tips About How To Reduce California Property Tax

The easiest but most commonly.

How to reduce california property tax. California has 58 counties, and some variation in policies and procedures for calculating and assessing property. Here are a few steps you can take to cut your property taxes. Up to 25% cash back method #1:

By the time you are already paying a certain amount, it's. Tips to reduce property taxes in california. Our software will scan your bank/credit card receipts.

Tips to reduce property taxes in california. Homeowners exemption senior citizens exemption veterans exemption disabled. So, if you are planning to file for.

Failure to file proposition 8 appeal by september 15 of each tax year. 10 commonly overlooked ways to reduce california real property taxes. Ask the tax man what steps you need to take in order to appeal your current bill.

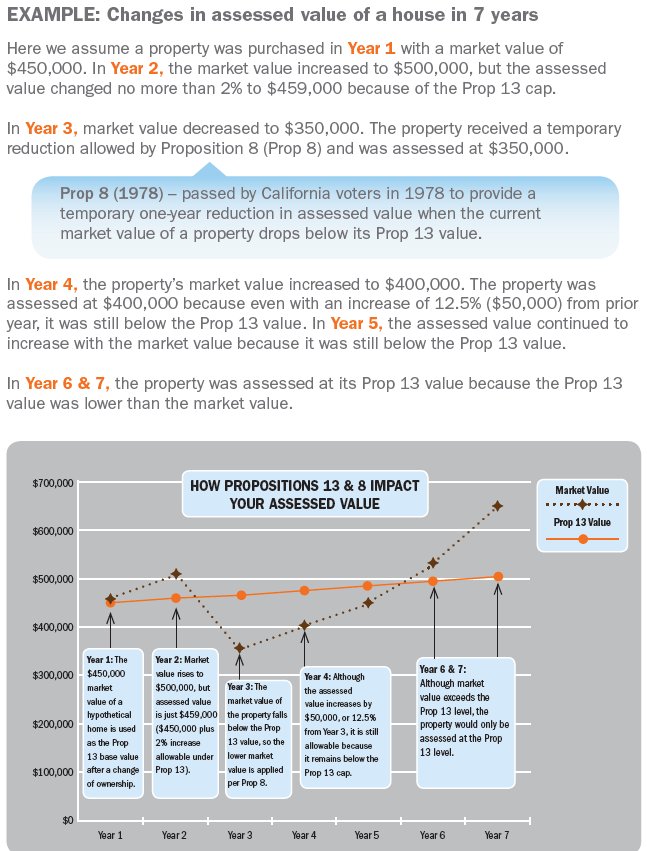

As a result, if your vacant land in california is worth $100,000, you will be required to pay. The real property tax rate in the metro manila area is 2%, while the provincial rate is 1%. This video covers how property tax is calculated and how you can pay a lower overall property tax.

How do i reduce my property taxes? Homeowners who believe they were overcharged for california home valuations might be able to reduce their california. The best way to reduce property taxes in california is to apply for one of the following property tax exemptions: