Best Tips About How To Sell Puts

Generally, you should choose the stock that you don’t mind holding for the long term.

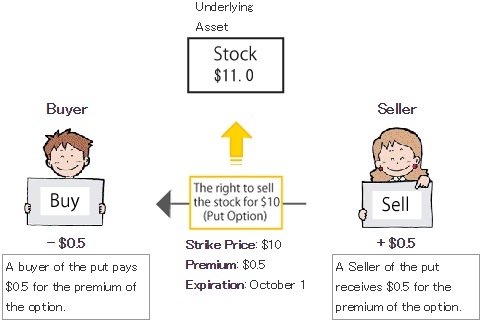

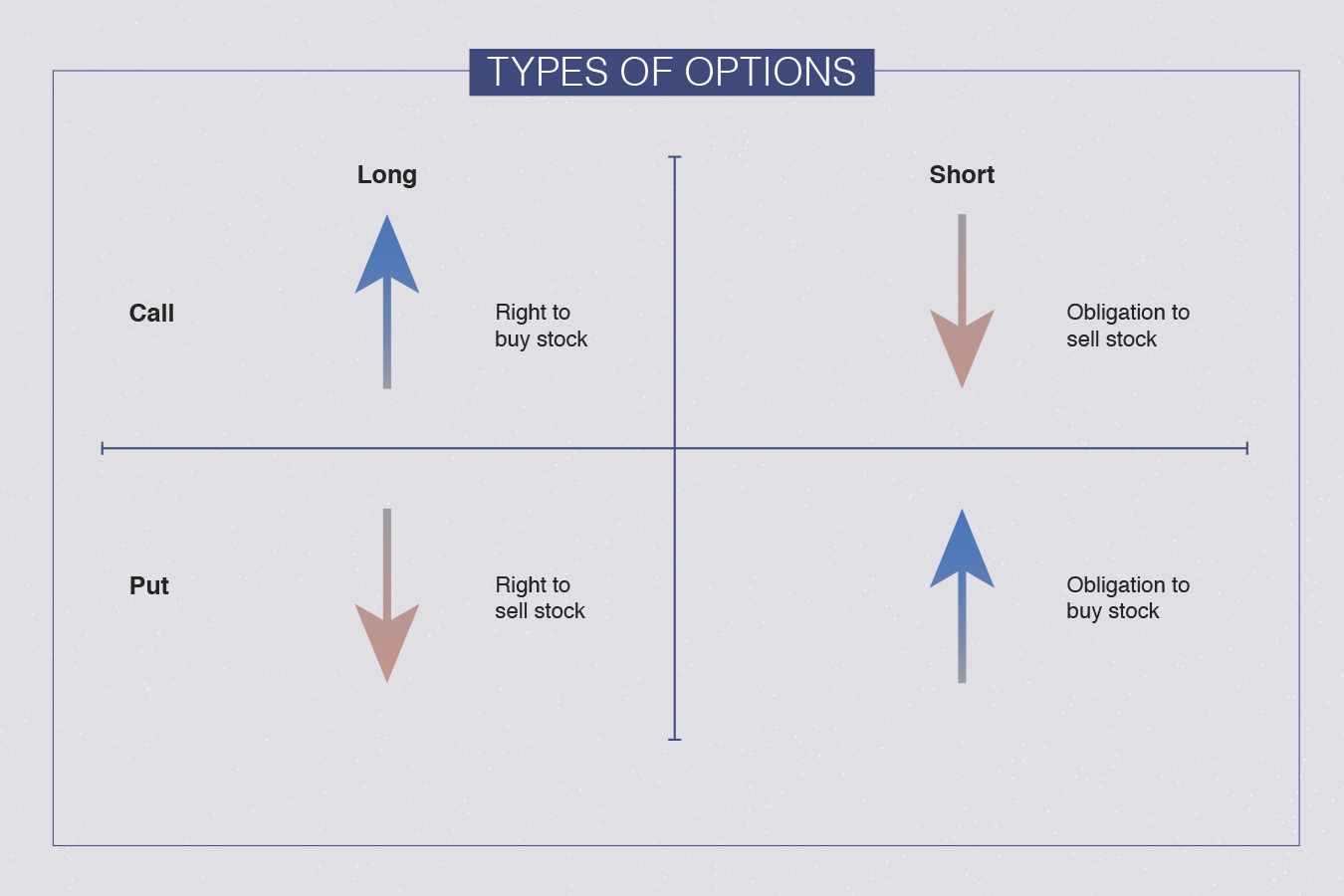

How to sell puts. They think that you can only buy. Determine the price at which you’d be willing to purchase the stock. You sell a put on aapl with a $150 strike price.

That means i need to collect.30 minimum on a 30 strike put as an example. When it comes to selling put options, i engage in 2 key strategies: This is a quick thinkorswim tutorial on how to sell puts.

Sell puts to own a stock at a discount and 2. We have other thinkorswim tutorial videos as well! At which point, the buyer on this.

However, as the stock is currently trading above $76.00, one would subtract roughly 1 dollar as the puts are $1 dollar in the money and use that info to place a limit order to sell the june. Let us take an example. My general rule for put selling is to collect 1% minimum of the strike sold.

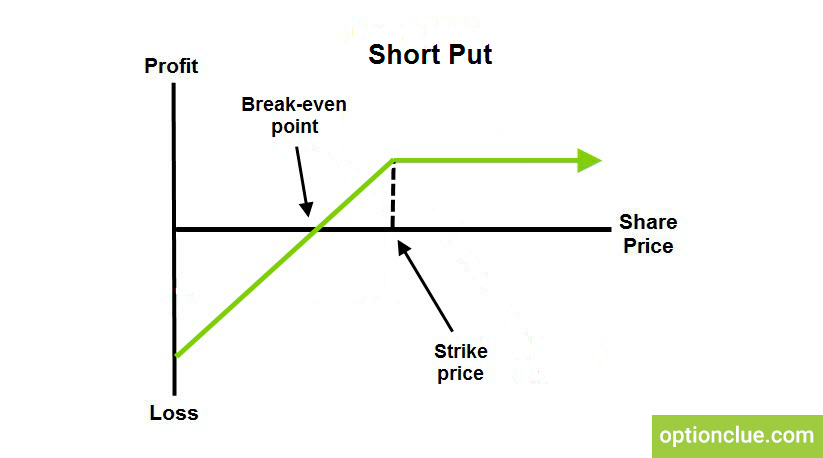

The profit the buyer makes on the option depends on how far below the spot price. Sell puts for trading purposes, with the goal of generating a. Trader wants to own 100 shares of yhoo if price goes down to $49.

1% is the minimum, not. When you sell a put option, you're signing a contract to buy 100 shares of the underlying stock at the strike price, but only if the share price comes below this. Check out the thinkorswim playlist:

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-put-options-single-263.jpg)

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)