Nice Info About How To Reduce Credit Card Processing Fees

In addition to payment processing fees, there are several other fees.

How to reduce credit card processing fees. Ways to minimize those risks and possibly qualify for lower. One of the easiest ways to lower your credit card payment fees is going right to the source — the payment processor. Other ways to lower credit card transaction fees.

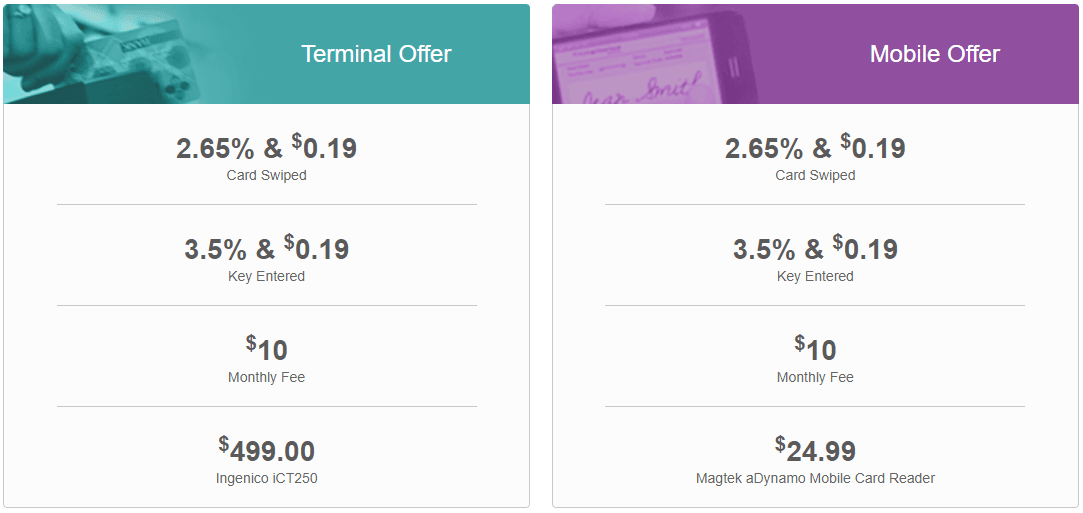

Learn where these fees come from and how you can reduce your cost in our comprehensive guide. A credit card processor is an important tool for companies that have high risk credit profiles. The lowest cost way to process a transaction is to swipe cards, and with new mobile integrations with smart phones and tablets, this is now becoming easier than ever.

The first step is to use a. Use an address verification service for credit cards. Negotiate with credit card processors.

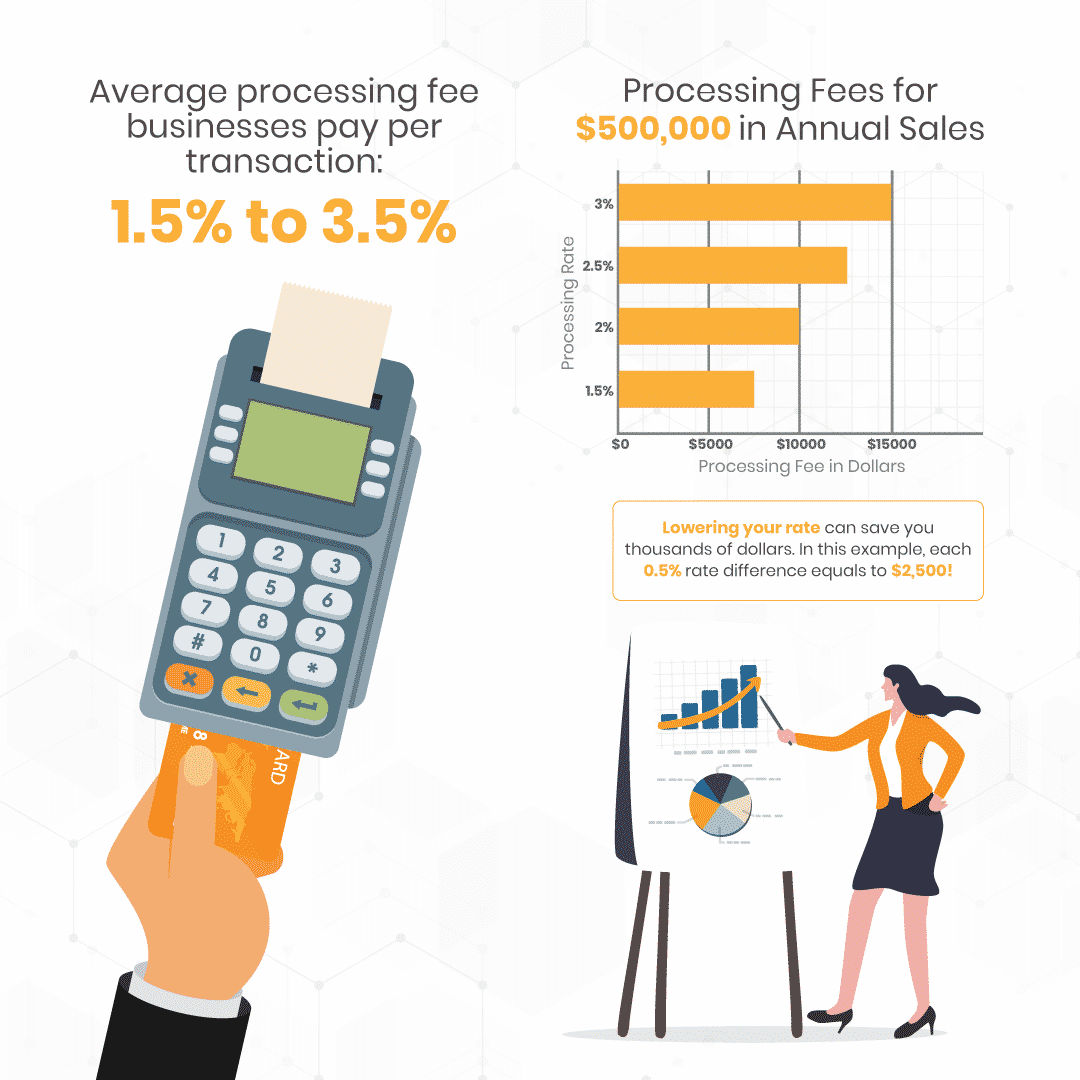

As a result, card not present transactions are processed at a higher interchange fee than card present transactions. Average credit card processing fees range from 1.5% to 3.5%. Whether you’re fed up with your current credit card processing company or are just shopping around for another option, changing plans may be your best option to get lower fees.

Shop around and negotiate for the best rates. These steps will keep you on the low end of the range. As the name implies, the merchant is charged the same amount per transaction regardless of the card type or where it is used.

They are interchange fees and assessment fees. Read on for 8 practical tips that can help you save hundreds a month. It is actually possible and encouraged.