Fine Beautiful Info About How To Avoid Gift Tax

Let's say you passed away the day after giving your daughter $76,000.

How to avoid gift tax. Respect the gift tax limit. Spread a gift out between. You can make gifts up to $15,000 per beneficiary during the year, and they won’t be included in your “taxable.

While this process takes longer than other methods of avoiding the gift tax on real estate, it allows the property transfer to be under the limits of the gift tax. The best way to avoid paying the gift tax is to stay within the limit set by the irs. 5 tips to avoid paying tax on gifts.

Political and financial speculation should not stop you from making gifts that benefit your loved ones. Keep gifts within the annual limit. Here are four strategies that you can use today.

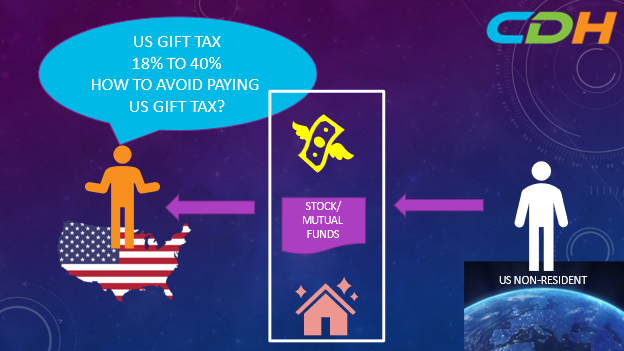

The tax applies whether or not the donor. The annual exclusion and the lifetime exclusion. There are two exclusions that stop most people from ever paying a gift tax:

Your estate avoids estate tax on the first $12.06mm of assets. There is a limit on the amount of wealth an individual can transfer during their lifetime without having to pay gift taxes. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return.

If you give someone a gift exceeding $16,000, whether it’s real estate, stocks or bonds, you’ll have to file form 709. There are a number of strategies that you can employ to ensure to avoid paying the gift tax. Anything above that is subject to gift tax and counts against your lifetime limit.